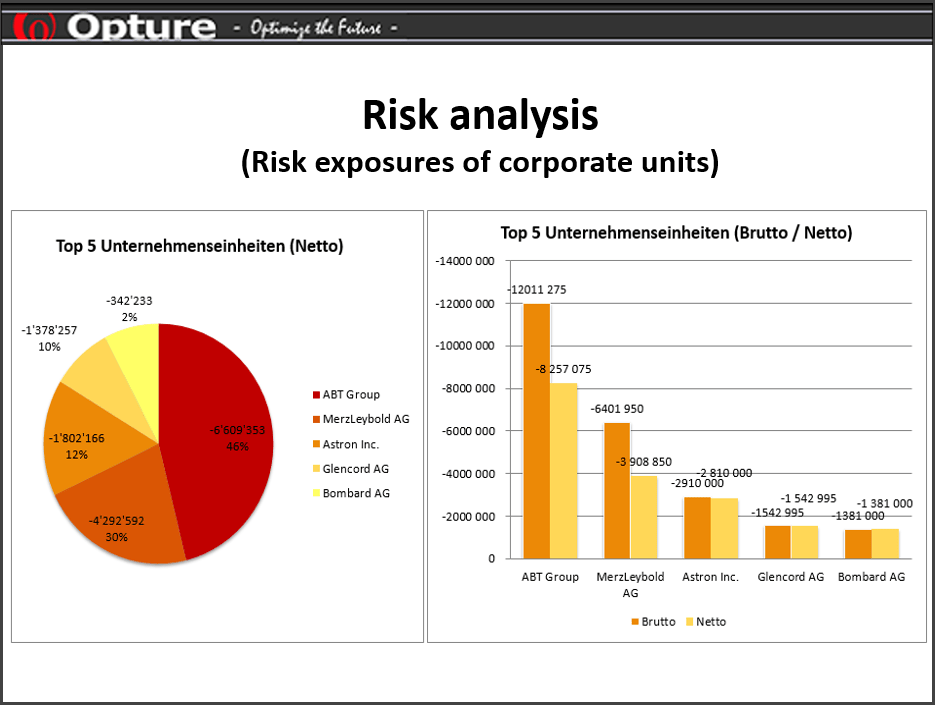

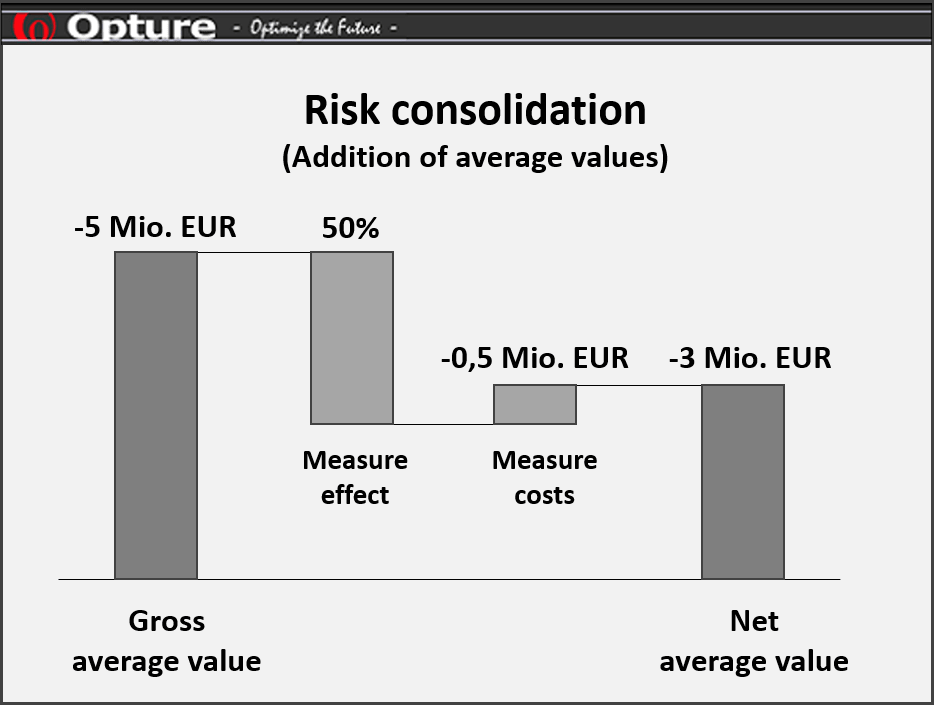

The risk consolidation describes the aggregation of risks based on expected values (gross and net). The addition of risk average values is allowed to calculate the expected risk exposure. Often, the term "risk consolidation" is used interchangeably with the term "risk aggregation". However, risk aggregation differs from risk consolidation in that aggregation takes into account the correlations (-> interactions) between risks through risk simulation procedures. With risk aggregation, primarily risk key figures such as VaR, CFaR, EaR, RAROC, RAC, etc. are calculated. Risk average values will be calculated as part of the risk management software Opture ERM Basic (-> risk consolidation) and risk figures as results using Monte Carlo simulations are calculated by the risk management software Opture ERM Advanced and Expert (-> risk aggregation).

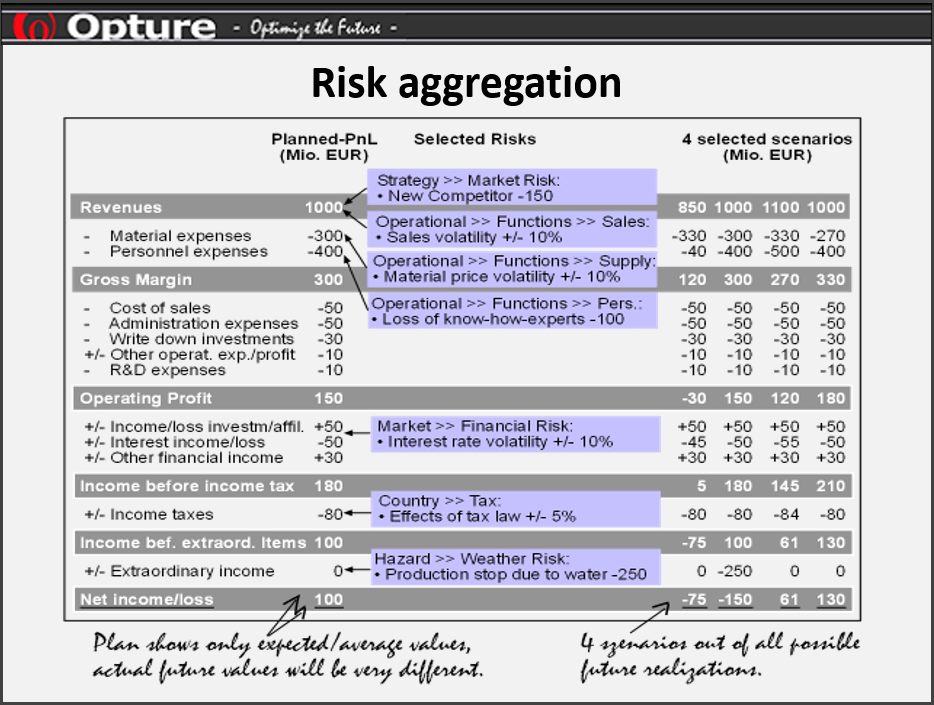

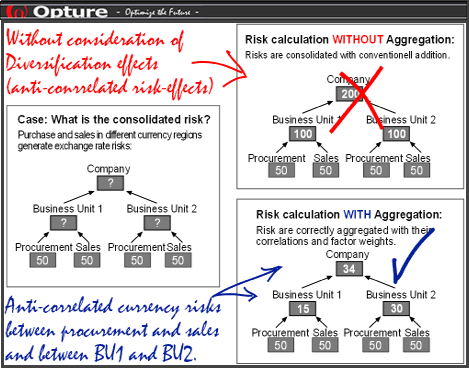

Example of risk consolidating (see picture): A company has two business units (BU), each with purchase and sales departments. The risks are presented in the form of EBIT volatilities with an amount of EUR 50 million per year. What is the consolidated risk of the company in terms of Holding EBIT volatility?

Risk consolidation: With the intuitive approach, the risks average values would be added, with a profit of € 100 million for each business unit and € 200 million for the whole enterprise. This would the correct result for the specific case that all risks are fully (100%) positively correlated. However, this case is not the normal case because the sales and purchase departments and / or business units always contain some dependencies / interdependencies (e.g., correlations or anti-correlations). In practice there are diversification effects between purchase and sales and / or different business units. The task of risk controlling and risk management consists the quantification of these effects and the calculation of correctly consolidated risk figures.

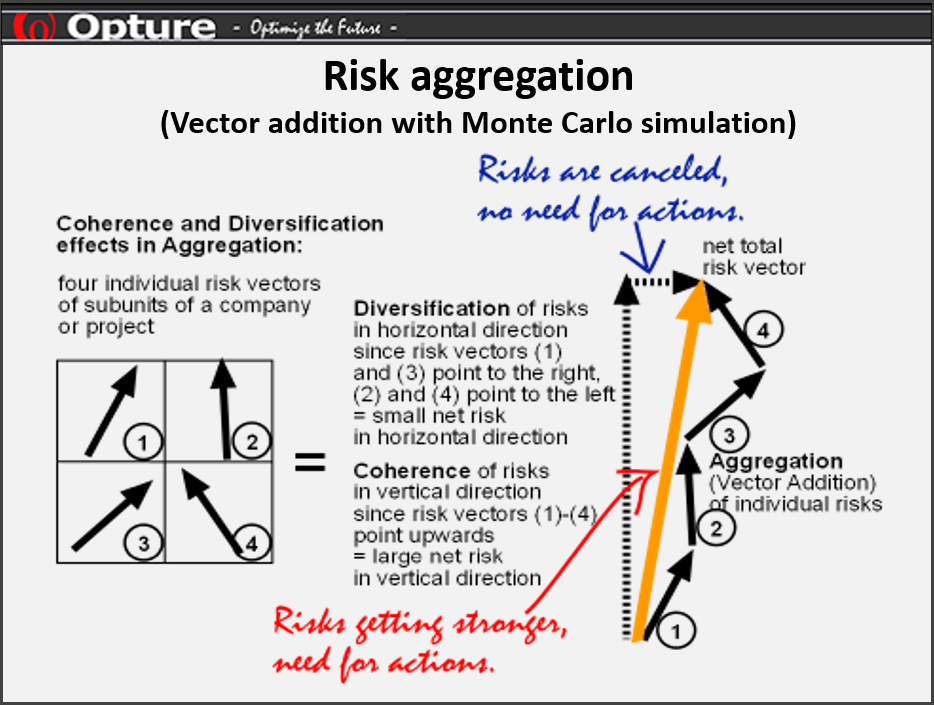

Risk aggregation: For risk aggregation it is necessary to quantify the correlations between purchase and sales as well as the business units. Insofar as the risks of purchase and sales due to anti-correlated effects, e.g. in terms of exchange rate effects, the risk effects are eliminated to a certain percentage, with large diversification effects at the business entity level (the risks of the purchase and sales department in the graph are correlated with -95.5% and -82%). If two business units operate independently of each other and there are no common factors, then the assumption is that the correlations are negligible (e.g. correlations=0%, as assumed in the graph). Furthermore the assumption is that diversification effects exist even without given correlations. The result shows that correct aggregation, with consideration of correlations, can lead to diversification effects that reduce the overall risk to 1/6 of the intuitive value with conventional risk addition.